The Two Keys to the Magic Formula for Long-Term Investment Success

Investing in anything comes with a degree of uncertainty because all investing returns happen in the future. And even though the future is unpredictable, the future is what everyone who invests is investing for. These realities present important challenges that every investor must face and deal with in order to succeed.

But even though we cannot predict the future with perfect precision, there are prudent and rational actions that investors can take that can bring an element of certainty into an uncertain process. This article will review two key strategies that investors can implement to improve their odds of successfully investing in common stocks in an uncertain world.

Keys to investment success: Fair valuation and earnings growth

The first key: Assessing fair or sound valuation

The first major key to successful long-term investing in stocks is to get valuation right on the buy side. I’ve written extensively on fair valuation in my last article found here.

One of the primary points made in the above article about valuation is that it is a measure of soundness and not an indicator of potential future return. I also pointed out that one of the key points about paying attention to fair value is that it positions you as an investor to achieve results commensurate with what the company is capable of generating as a business. This represents the essence of soundness.

This is critically important and worthy of repeating. Fair valuation empowers the investor to receive the full complement of what the business invested in is capable of producing earnings-wise. In other words, when you are disciplined enough to only invest when fair valuation is present, you position yourself to earn returns that are consistent with what the underlying business earns. However, it’s important to recognize that this means getting the good and/or the bad depending on the individual company. The following excerpt from my previous article elaborates on this point:

“Just because you buy a stock at value doesn’t necessarily mean that you will receive a high return. This is because value, although important, is only one component of future return. The other important component is the earnings growth rate of the business.

“To clarify, you can buy a slow-growing company at sound valuation and even at the same valuation as a faster-growing company, while still earning only a modest rate of return. In fact, it could be argued that only being willing to invest at sound valuation is more critical for a slow grower than it is for a faster grower.”

At this point I will also add that it is also possible to buy a company at fair value based on current earnings and lose money if future earnings fall dramatically. This is where forecasting future earnings in addition to assessing fair current valuation comes into play.

The second key: Estimating future earnings growth

Estimating future earnings growth is the second major key to successful long-term stock investing. This is especially relevant to the business perspective investor because you are actually investing in the business, not the stock. Consequently, the success of the business that you invest in is going to be the primary determinant of how much money you can expect to earn on that investment. Stated more directly; when you invest in a business, you are buying its future earnings potential.

The only logical reason I would ever want to invest in a business is because I believe the company is a profitable enterprise. Like all business owners, I recognize that my reward can only come from the future profits the business can generate on my behalf as an owner. Moreover, the growth of those profits will represent the primary source of the future total return I can expect to receive from investing in it. In the long run, the market will capitalize future earnings growth (apply a reasonable P/E ratio) which will generate my potential capital appreciation, and dividends, if any, will also come from future profitability. Of course, this only applies if I originally invested in the business at fair value.

Therefore, I believe as investors, we cannot escape the obligation to forecast future earnings, because our results depend on it. Furthermore, we should not guess, nor should we simply play hunches. Instead, we must attempt to calculate reasonable probabilities based on all the factual information that we can assemble. Then we should apply analytical methods based upon our earnings-driven rationale that provide us reasons to believe that the relationships producing earnings growth will persist in the future. In other words, we must strive to forecast future earnings as accurately as we possibly can. On the other hand, we should simultaneously realize that perfection is not to be expected.

As an aside, there are many who criticize or even claim that we should avoid utilizing forward earnings forecasts when trying to determine fair value, or even when trying to decide what stock to own. I find these positions rather bizarre. I cannot think of any logical reason why anyone would invest in a business, unless they had a reasonable expectation of that business’ ability to generate future profits. Since I am confident that both capital appreciation and dividend income will be a function of the company’s future earnings power, estimating future earnings must be an essential element of long-term success.

Consensus earnings estimates accuracy

Looking for attractive dividend-paying stocks to add to your retirement portfolio? You might want to try trusting analysts’ estimates to aid in your selection process. I cannot tell you the exact number of times that people have commented on how inaccurate analyst estimates are in my articles over the years. However, I can confidently state that there have been many.

Nevertheless, I have always found those comments rather strange. It seems to me that rational people would recognize that forecasting the future of anything can never be perfectly precise. In other words, to how high of a standard should we hold analyst earnings estimates? I will add my personal view a little later in the article. But before I do, I would like to call attention to what I consider excellent work on the subject by highly respected fellow Seeking Alpha author Jeff Miller.

Jeff prepared two separate articles on the subject of forward earnings forecasts found hereand also here.

Interestingly, both articles were written in 2010; however, I consider the content just as relevant today as it was back then. One of the primary points that Jeff expressed in these articles is that the perception that analyst estimates are unreliable was based on studies that evaluated long-term earnings growth rate forecasts. However, Jeff pointed out that analyst forecasts over shorter periods of time tend to be more accurate, and for the most part, conservative. For those not interested in reading both articles in their entirety, I include the following two excerpts that I consider irrelevant to this article:

‘Analysts’ forward earnings estimates are very good for a one-year time frame’

“To emphasize, in the forward earnings series I am taking this one step at a time.

- Earnings are important. Eventually, stock prices reflect the fundamentals. If you do not understand this, you should read some of the work from Chuck Carnevale, whom I have cited on several occasions.

- If you have a better estimate of next year’s earnings, you will have an investment edge.

- The consensus forward estimates are the best method of looking one year ahead. I do not know of any better source. Suggestions are most welcome, but please provide evidence.”

The market application

“There is a constant drumbeat of criticism about market valuation using forward earnings. The most common criticism, that estimates are too optimistic, is open to challenge. If the estimates are too high, why is the beat rate consistently in the 65% range?

“The key choice is the same as our football example. The fans of the Shiller 10-year past earnings method take pride in having solid data. Then they make wild guesses about whether the trend will continue. Those praising this method point to a few notable successes, mostly times when P/E ratios were very low since interest rates were very high.

“Those interested in forward earnings are taking the aggregate work of dozens of specialists. If you think they are a little high, you can feel free to add an error range. If you do so, you should look at past data – especially that of recent years.”

Additionally, we must ask ourselves the question: just how accurate do analysts’ estimates need to be to be of real value? I believe the answer to this important question is – within a reasonable range of probability. Since forecasting is all about the future, and much of the future is an unknown, we must accept the fact that estimates will contain a level of imprecision. Therefore, we should expect discrepancies to manifest when our forecast eventually turns to actual reality (reported earnings).

Furthermore, I believe it would be naïve to expect analysts’ estimates, or even consensus estimates, to be perfect. There are a lot of unknown variables in the future that could affect the ultimate results. Furthermore, many companies, especially multinationals with numerous divisions and diverse businesses, are complex enterprises with a lot of moving parts. Therefore, and once again, I believe that the best that a rational person can hope for is that estimates fall within a reasonable range of probability and accuracy.

In addition to the flaws that Jeff Miller pointed out behind the perception that analyst estimates are inaccurate to the point of being worthless, I would like to add my own perspective. As previously stated, these perceptions are based on numerous studies that have been conducted on the accuracy of analyst estimates. However, in addition to these studies analyzing forecasts that are too far forward, they also tend to focus on stock price movement immediately following earnings surprises.

However, the biggest problem I personally have with these studies is that they are based on analyzing a large group of stocks. The reason I have a problem with that is because the accuracy of one- or two-year forward earnings estimates by analysts vary dramatically from one company to the next. Stated more plainly, some companies are easy to analyze and forecast, while others are much more complex. Therefore, I prefer analyzing the accuracy of analyst estimates one company at a time.

In other words, I am not as concerned with how accurate forecasts have been in the aggregate as I am with how accurate analysts’ forecasts have been for the individual company I am examining or interested in investing in. It is for this reason that the F.A.S.T. Graphs™ fundamentals analyzer software tool that I co-developed includes an analyst scorecard reporting the historical accuracy of analysts’ forecasting record on each individual company for one-year forward and two-year forward timeframes.

As previously discussed, I believe that forecasting the future earnings power of a business is a major key to long-term investment success. On the other hand, as stated just above, some companies are easy to forecast and others very difficult. Consequently, my personal preference is to seek out companies that are easy to forecast and avoid those that are difficult. I believe it is both interesting and logical that companies with the most consistent historical record of operating excellence are the easiest with which to forecast future earnings. Utilizing the F.A.S.T. Graphs™ earnings and price correlated graphs, Forecasting Calculators and Analyst Scorecard, I offer the following three examples to illustrate my point:

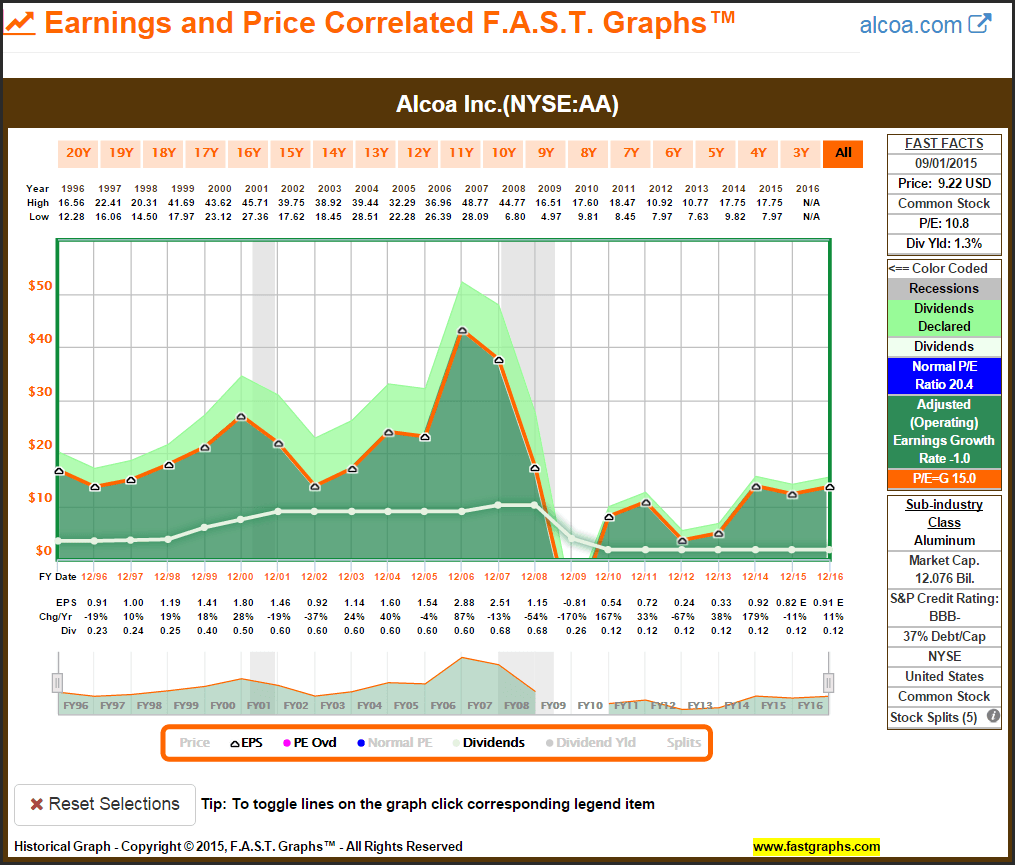

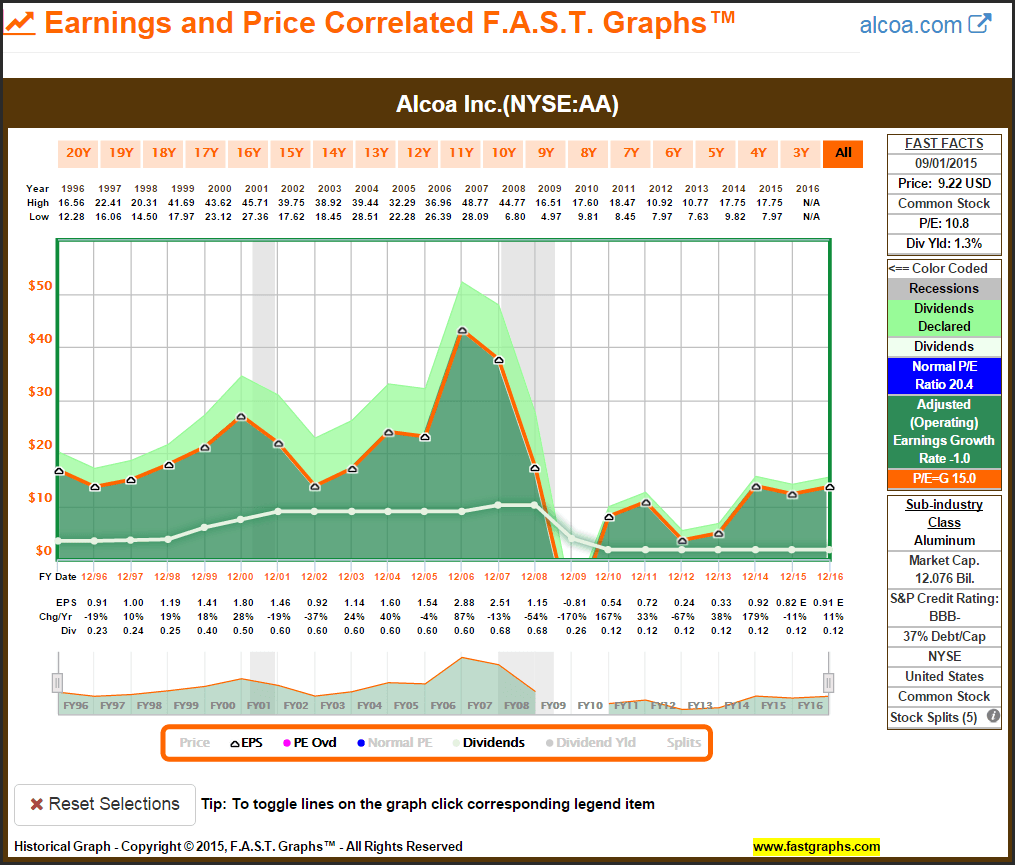

Alcoa Inc.: Difficult to trust analyst forecasts

All it takes is a quick glance at Alcoa’s (NYSE:AA) historical earnings results to recognize that forecasting future earnings for this deep cyclical would be very challenging. Since 1996 earnings have risen, then fallen, then risen again, then collapsed and disappeared, then rose and fell again and again. Personally, with this example I see no point in even trying to forecast future earnings.

[ Enlarge Image ]

[ Enlarge Image ]

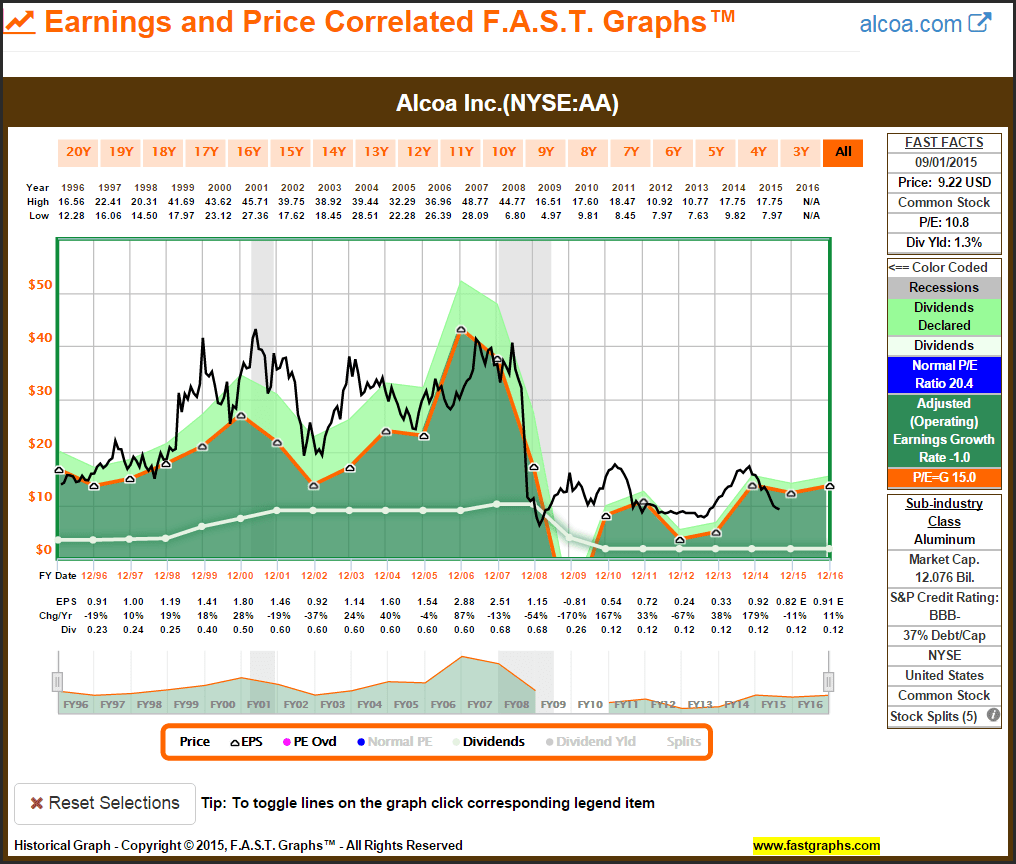

With this next graph, I add monthly closing stock prices. As cyclical as Alcoa’s earnings have historically been, its earnings and price correlated record is a poster child for the importance of earnings. This also illustrates the point I made earlier that you could invest at fair value (when price is touching the orange line) and still lose money.

[ Enlarge Image ]

[ Enlarge Image ]

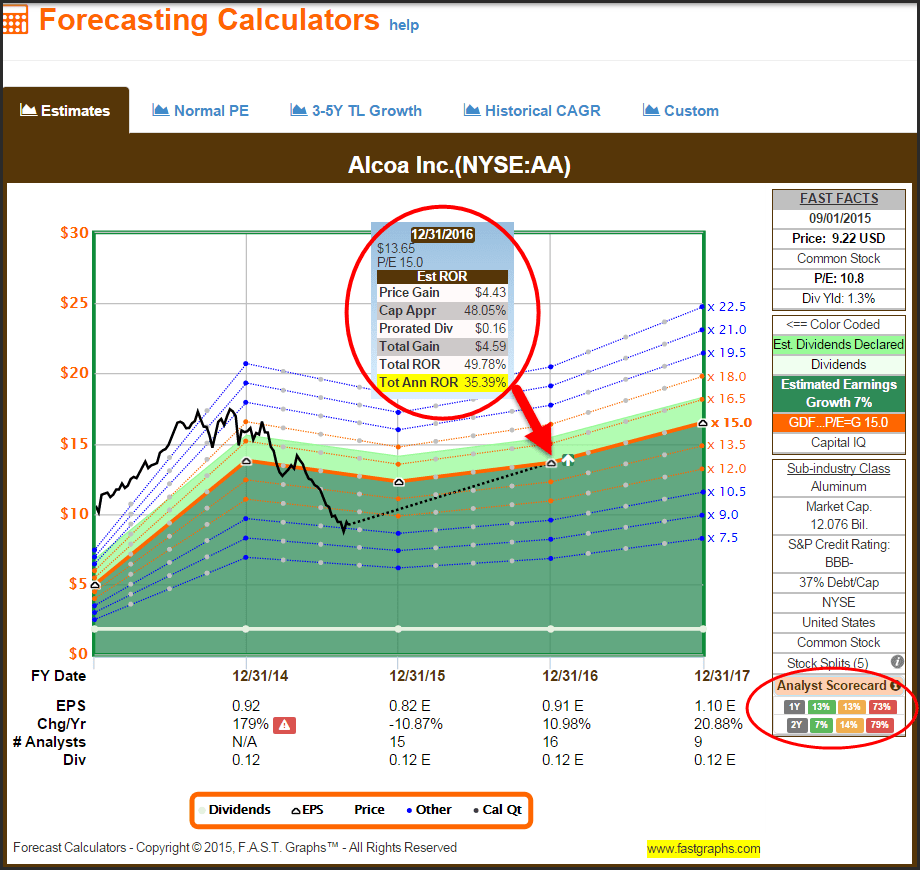

At first glance, the near-term earnings Forecasting Calculator based on 15-16 analysts reporting to S&P Capital IQ would indicate that Alcoa is attractively valued and poised to generate earnings growth over the next couple of years. This would imply a very exciting potential total annualized rate of return out to fiscal year-end 2016 if those estimates could be trusted.

[ Enlarge Image ]

[ Enlarge Image ]

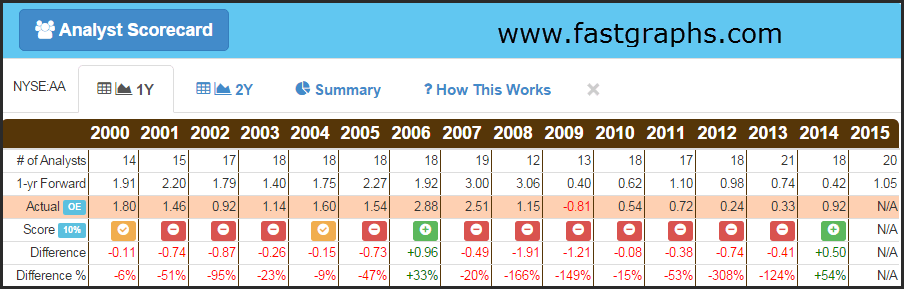

However, a quick glance at the Analyst Scorecard on one-year forward forecasts on Alcoa suggests that trusting those earnings forecasts might be quite risky. Analysts have been wrong to the downside, and in many cases extremely so, approximately 73% of the time. To me this says that not only can I not trust analyst earnings forecasts on this specific company, I see no reason to attempt to do it myself. This is clearly a difficult company to forecast future earnings on.

[ Enlarge Image ]

[ Enlarge Image ]

The analyst scorecard based on the historical record of forward analyst earnings estimates two years out is even worse. When making two-year forward earnings forecasts on Alcoa, analysts have been wrong approximately 79% of the time, and once again, their misses were by a wide margin.

[ Enlarge Image ]

[ Enlarge Image ]

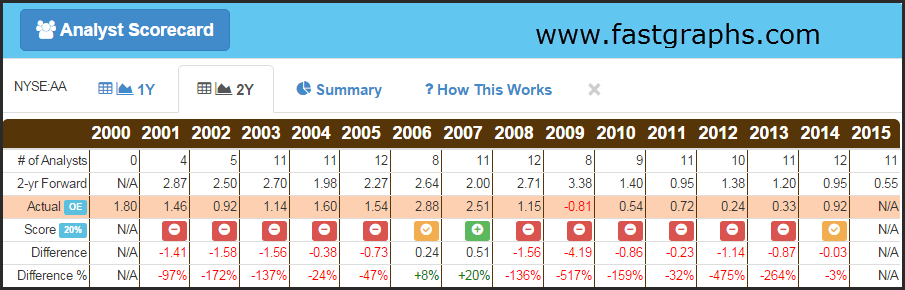

The following summary of the historical record of consensus estimates on Alcoa for one-year and two-year forward timeframes has been abysmal. Therefore, as previously stated, I would not trust analyst forecasts in this case, and I would not have the confidence to attempt to make forecasts of my own.

[ Enlarge Image ]

[ Enlarge Image ]

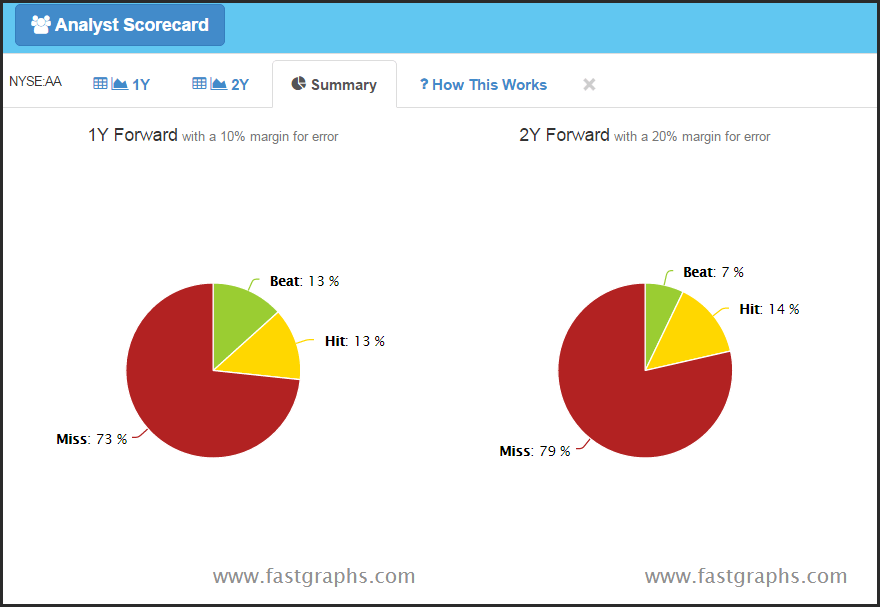

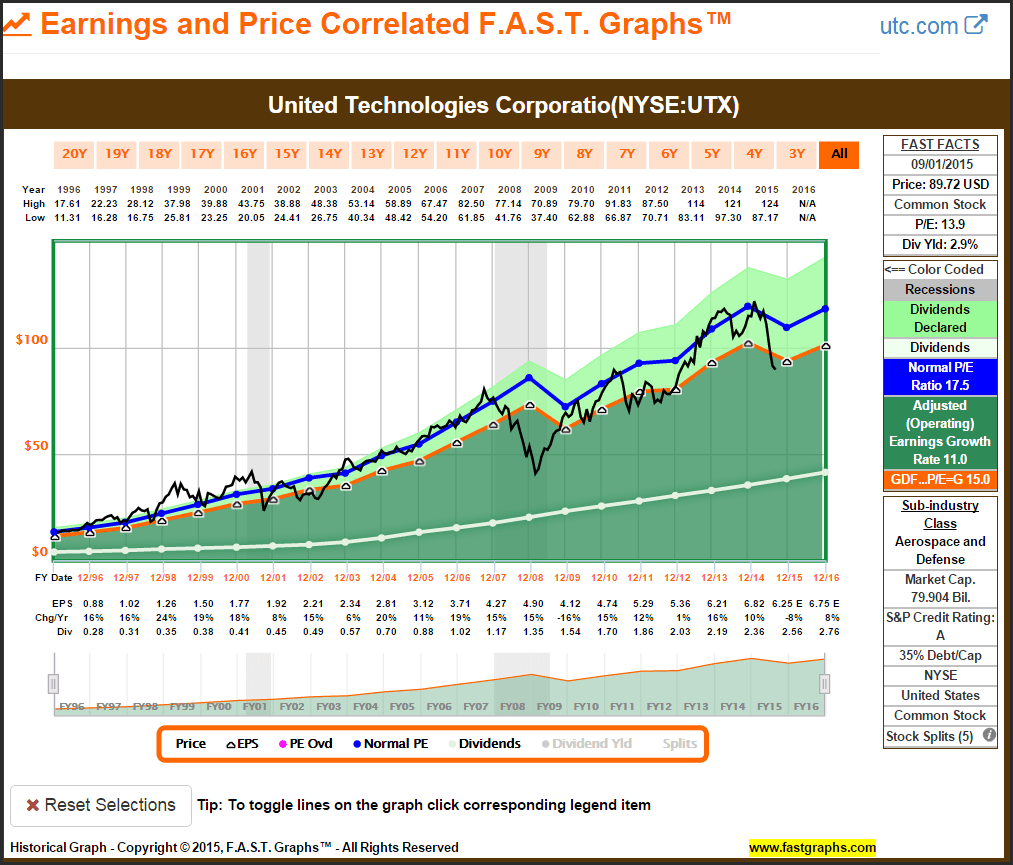

United Technologies Corporation: High credibility with analyst forecasts

In contrast to the historical earnings record we saw on Alcoa, the historical earnings record of United Technologies (NYSE:UTX) is much more consistent. Many would also consider this aerospace and defense conglomerate a cyclical company. However, it is clearly not a deep cyclical like we saw with Alcoa.

Personally, I consider this high-quality company more of a long-term growth story than I would a cyclical stock. There have been the occasional drops in earnings, but for the most part United Technologies has been a consistent above-average grower. This company is also a Dividend Contender on fellow Seeking Alpha author David Fish’s CCC lists that has increased its dividend for 22 consecutive years. Based on its relatively consistent earnings history, it is easy to see why.

[ Enlarge Image ]

[ Enlarge Image ]

Once again, when monthly closing stock prices are added to the graph, the importance of earnings is clearly revealed. In the long run, stock price tracks earnings, but in the short run volatility can be distracting.

[ Enlarge Image ]

[ Enlarge Image ]

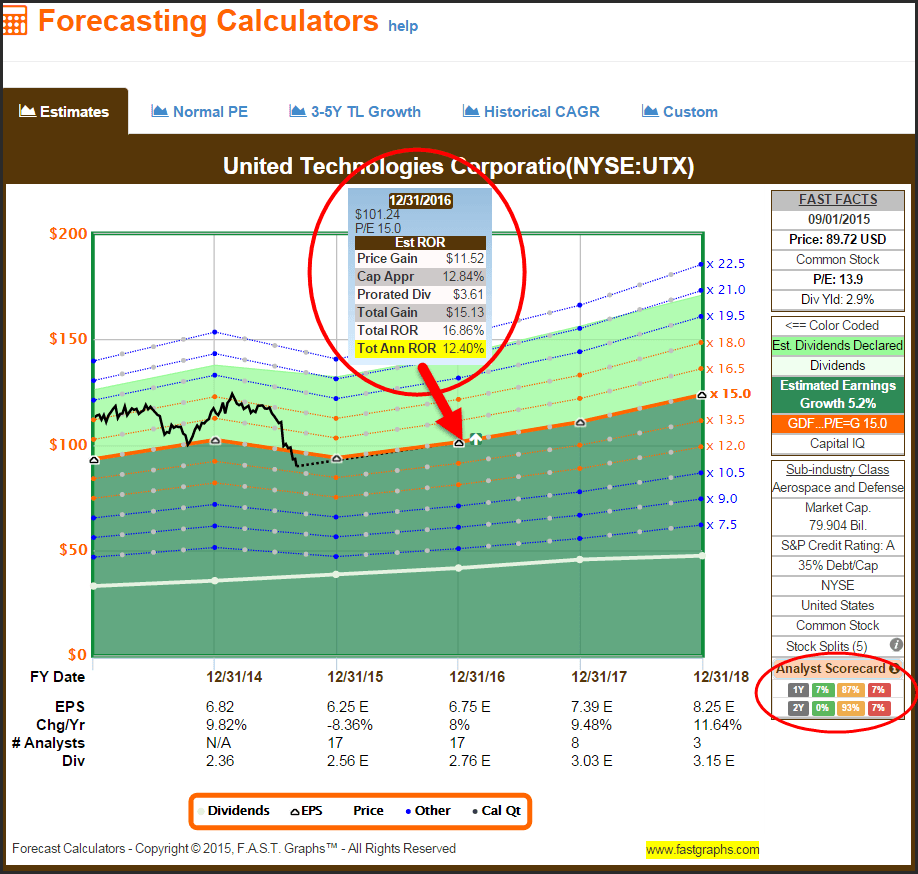

The forecasting calculator based on the consensus of 17 analysts reporting to S&P Capital IQ forecast a down year for fiscal year 2015, followed by 8% earnings growth for fiscal 2015. A quick glance at the Analyst Scorecard summary at the bottom right on the calculator provides confidence that these forecasts might be reasonable.

Assuming that there is a high probability that these estimates are reasonably correct, United Technologies appears fairly valued and offers the potential for a double-digit total annual rate of return out to fiscal year-end 2016. Moreover, the current dividend yield of 2.9% coupled with its history of growth is attractive.

[ Enlarge Image ]

[ Enlarge Image ]

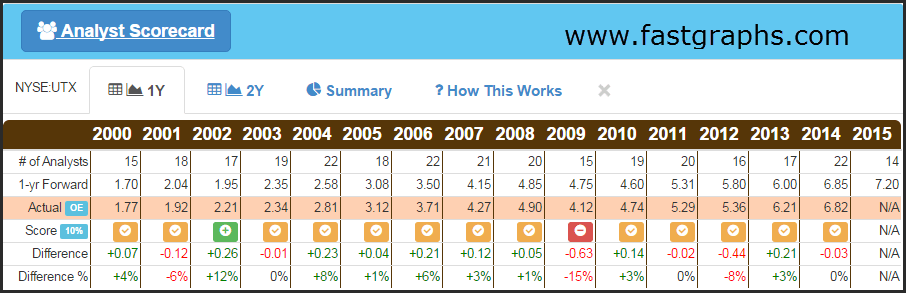

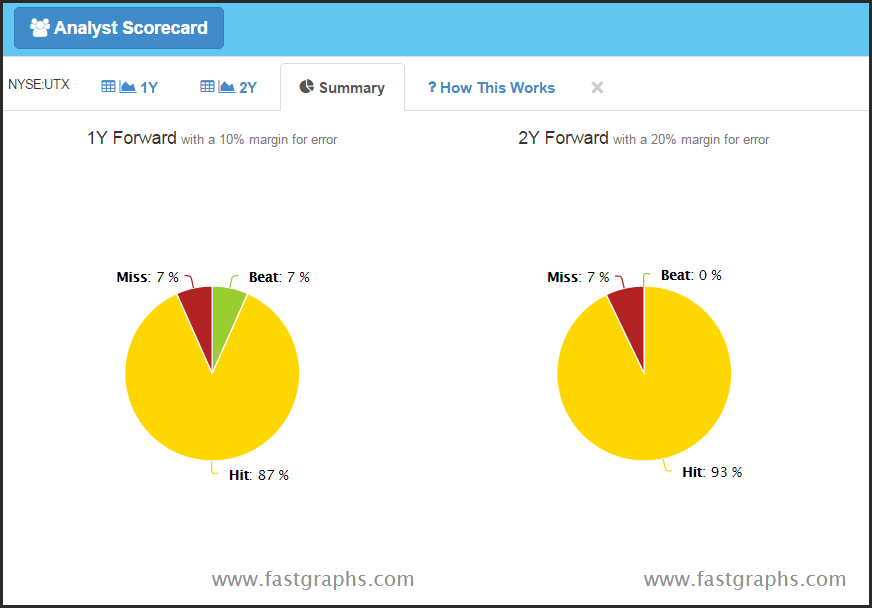

When you evaluate the details of the historical record of analyst forecasts one-year forward, you discover that the only real miss was in 2009 or just after the Great Recession. Otherwise, the record of analyst earnings forecast accuracy on United Technologies has been exceptional. Consequently, I have a high degree of confidence that next year’s earnings forecast could fall within a reasonable range of accuracy.

[ Enlarge Image ]

[ Enlarge Image ]

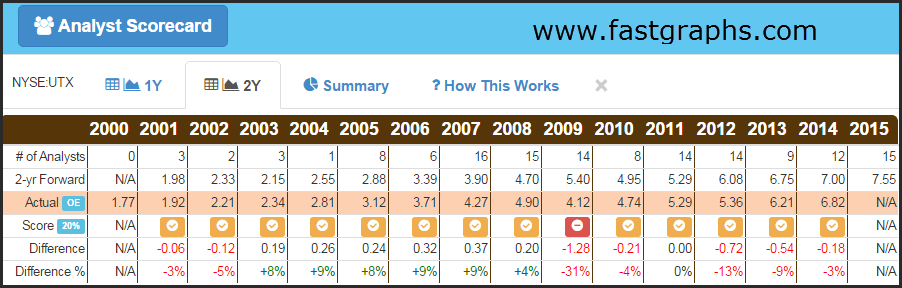

Additionally, the analysts’ historical record of two-year forward estimates is also quite high at 93%. Personally, I put more credence in closer estimates than I do those farther out. Therefore, I have more confidence in the one-year forward forecast, but my confidence in the accuracy of the two-year forward forecasts is also high.

[ Enlarge Image ]

[ Enlarge Image ]

United Technologies is a conglomerate, and as such, it would be easy to assume that forecasting future earnings would be difficult. However, the following summary of the record of analysts making forecasts one year and two years forward on United Technologies has been quite good.

[ Enlarge Image ]

[ Enlarge Image ]

Johnson & Johnson: Extreme confidence in analyst forecasts

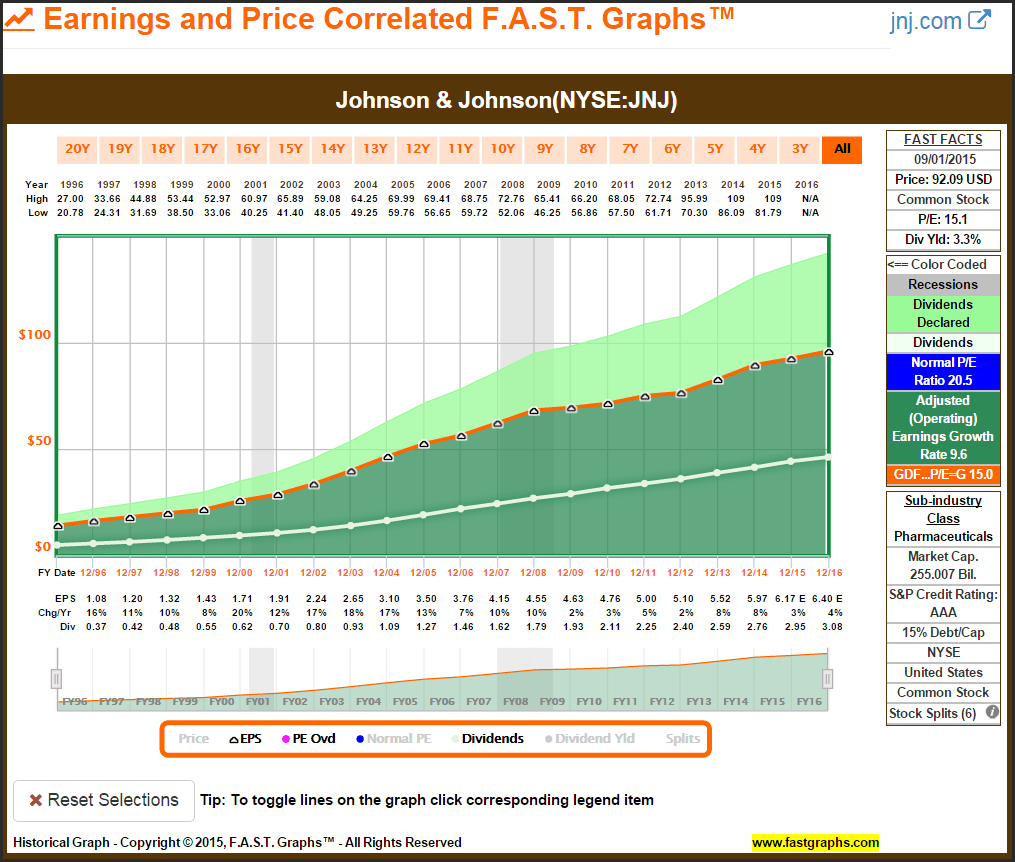

Many investors, especially dividend growth investors, consider Johnson & Johnson(NYSE:JNJ) the premier dividend growth stock based on quality and consistency of earnings and dividend growth. This blue-chip Dividend Champion represents the keystone for many retired investors’ portfolios seeking quality and a growing dividend income stream.

[ Enlarge Image ]

[ Enlarge Image ]

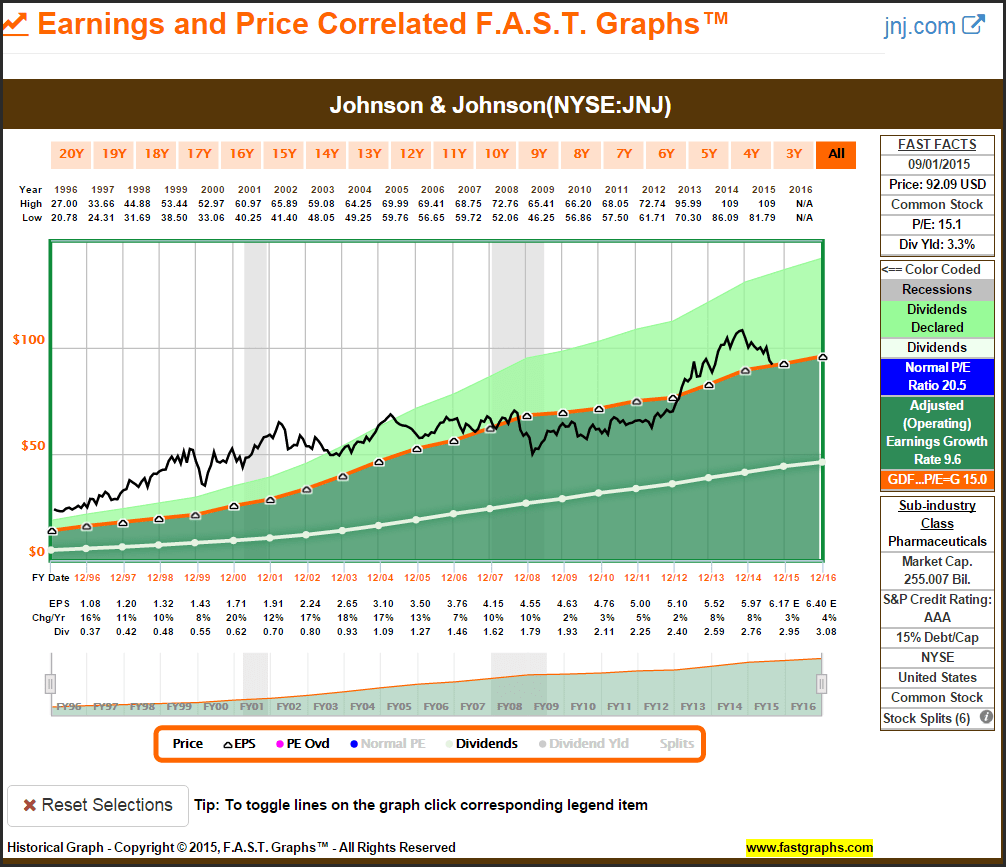

Even though I agree that AAA-rated Johnson & Johnson is one of the premier dividend growth stocks on the planet, I have often been discouraged by its historical high valuation. However, the good news is that Johnson & Johnson has recently moved back to fair value. Consequently, I consider Johnson & Johnson an excellent choice for retired investors concerned with quality and safety.

Johnson & Johnson has rarely been the best performing dividend growth stock; however, it has long been one of the highest quality and most consistent performers. Therefore, I consider Johnson & Johnson an excellent choice at current valuation.

[ Enlarge Image ]

[ Enlarge Image ]

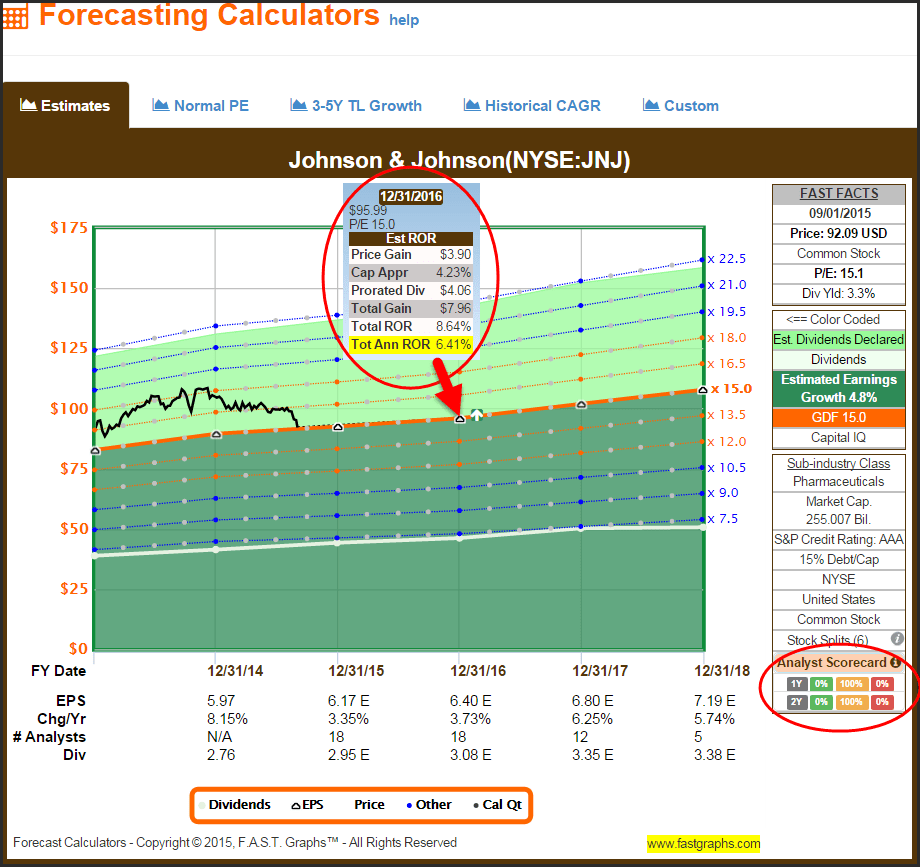

On the other hand, Johnson & Johnson also represents an excellent example of what I stated earlier about fair valuation and high returns. The consensus of 18 leading analysts expects Johnson & Johnson’s earnings to grow 3.7% for fiscal 2016 followed by 6.25% for fiscal 2017 and then 5.74% for fiscal 2018.

Therefore, the estimated earnings growth out to 2018 is at a moderate 4.8%. Add in the dividend and assume that it grows consistent with expected earnings growth and a reasonable calculation of a total annualized return out to 2016 is 6.41%.

Make the same assumptions out to 2018, and the total annual return calculates to 7.9%. Therefore, although the expected future returns for Johnson & Johnson are only moderately above average, Johnson & Johnson’s quality is significantly above average. Prudent investors have long been willing to accept a lower rate of return for quality.

[ Enlarge Image ]

[ Enlarge Image ]

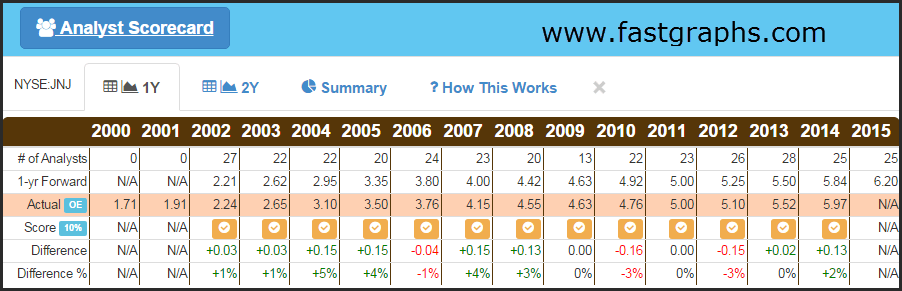

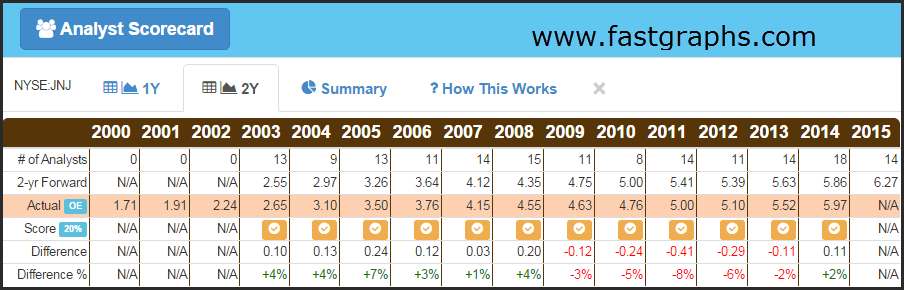

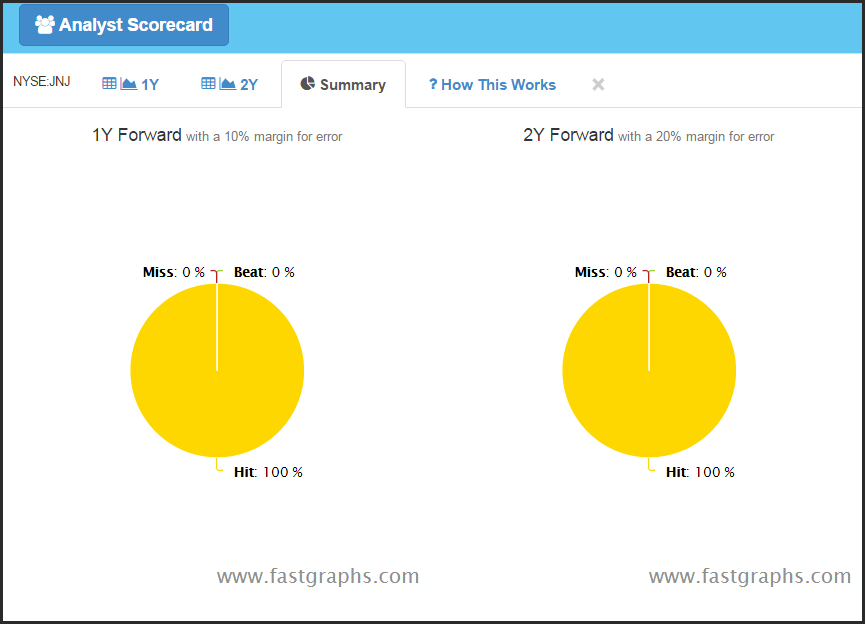

Both the one-year forward and two-year forward Analyst Scorecard for Johnson & Johnson have been 100% correct. Consequently, I believe it is logical to place a great deal of confidence in the earnings forecast for Johnson & Johnson seen above. This simply represents another positive reason to add Johnson & Johnson to retirement portfolios.

[ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ]

The magic formula for long-term investment success

In truth there is no magic formula for long-term investment success. On the other hand, I fervently believe that investing in high quality growing companies at sound and attractive valuations is as close as you will ever get. The two keys are to invest at sound valuation, and forecast future earnings growth as reasonably accurately as you can.

When this is accomplished effectively, you receive the additional benefit of a clear and reasonably accurate expectation of what your future returns might be. This brings an element of certainty to the uncertain process of investing in equities. Although none of this can be accomplished perfectly, I believe it is a lot more intelligent than investing only on hope.

As a bonus, I have prepared a free analyze-out-loud video on my website MisterValuationwhich provides a more in-depth and detailed look at fair valuation and the accuracy of analyst estimates on individual companies.

Summary and conclusions

Forecasting the future about anything always contains a level of uncertainty. Forecasting the future earnings and dividend growth rates of common stocks clearly falls into that category. However, that does not simultaneously mean that forecasts cannot be made within a reasonable range of accuracy to be useful or beneficial to investors. Investing is not a game of perfect, nor does it have to be.

On the other hand, I do believe that successful investing requires forecasting. As previously indicated, it would be completely illogical to invest in anything without at least an idea about what the future might bring. Consequently, it’s incumbent upon all investors to engage in forecasting. This represents an advantage to the business perspective investor because forecasting future business results is certainly more reliable and potentially more accurate than attempting to forecast short-term stock price changes.

I believe a great starting point is to examine the near-term forecasts of leading analysts following a company. This doesn’t mean blindly believing what they are forecasting. And, this doesn’t mean being naïve in thinking that analyst forecasts will be perfect. Nevertheless, successful investing implicitly hinges upon assessing a reasonable forecast of what the earnings of the business you are investing in is capable of generating. I think Warren Buffett(Trades, Portfolio) summarized it nicely when he said “It is better to be approximately right than precisely wrong.”

Disclosure: Long UTX, JNJ.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.