Warren Buffett Keeps Buying IBM

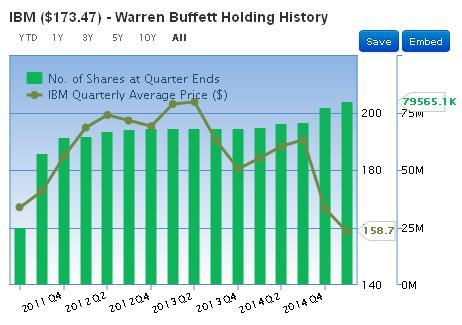

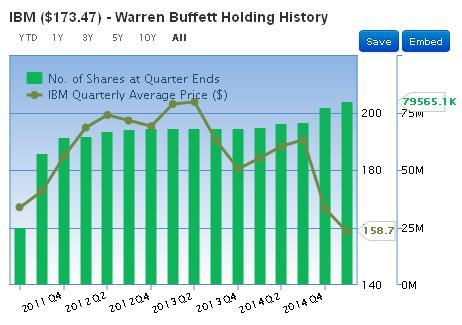

Warren Buffett (Trades, Portfolio) is one of the most respected value investors of all times. He seeks to acquire great companies trading at a discount to their intrinsic value, and to hold them for a long time. Buffett only invest in businesses that he understands. This is the reason why he avoided technology stocks for a long period. He made his first investment in tech sector in the second quarter of 2012 by buying International Business Machines (IBM). While, the company has underperformed the broader markets since then, he has used it as an opportunity to increase his holdings in the company. Last quarter he bought 2,593,298 shares of the company and his total holdings as of March 31, 2015 was 79,565,115 shares (or 8.08% of outstanding shares). The following chart shows his holding history in the company.

IBM is a leading IT services and consulting company. IBM creates value for clients through integrated solutions and products that leverage: data, information technology, deep expertise in industries and business processes and a broad ecosystem of partners and alliances. IBM solutions typically create value by enabling new capabilities for clients that transform their businesses and help them engage with their customers and employees in new ways. These solutions draw from an industry-leading portfolio of consulting and IT implementation services, Cloud and cognitive offerings and enterprise systems and software; all bolstered by one of the world’s leading research organizations.

The company has seen a good growth over the last 10 years, and its EPS has grown by 14.50% during the same period. However, over the last couple of years the company’s adjusted EPS has stagnated around $ 15. In FY2015, investors are expecting the company to post an EPS of $ 15.87. This has dampened investor sentiments and the company is now trading at 10.18 times FY2015 EPS. The company is also undervalued according to Gurufocus DCF Calculator which gives it a business predictability rating of four stars and margin of safety of 44%.

In order to reignite earnings growth, management has come up with a strategy to focus on high-margin and high-growth businesses. Specifically, the company is focusing on data, Cloud and engagement markets. Together, they posted double-digit growth in every quarter of 2014. Currently, high growth markets of Cloud, analytics, mobile, social and security accounts for 27% of the company’s revenues. IBM intends to grow these businesses to 45% of revenues over the next few years.

The company is also taking various steps to exit low margin businesses and concentrate on higher-margin, higher-value segments. In 2014, the company divested large businesses that no longer fit its strategic profile, System X and customer care BPO. It also announced the divestiture of its semiconductor manufacturing business. These three businesses drove $ 7 billion of revenue in 2013 but lost about $ 0.5 billion of pretax profit. While IBM certainly has a smaller business in terms of revenue and the divestitures reduced the number of employees, the remaining business is a higher-value, higher-margin business.

Cantor Fitzgerald analyst Brian White is optimistic about the company’s stategy and has a price target of $ 198 on the stock. In a recent research report he wrote:

“IBM Remains True to Values During Transition. IBM’s Ginni Rometty began with three key points that included reinforcing what IBM is as a company, discussing the current transformation and outlining the expected result. Essentially, IBM sees itself as a high-value innovation company at the intersection of business and technology. In terms of the transition, IBM discussed plans to shift an additional $ 4 billion into strategic imperatives (excluding acquisitions). Finally, IBM expects long-term sales growth of low-single digit and high-single digit EPS growth, with strategic imperative revenue reaching $ 40 billion, or over 40% of sales, in 2018.″

I believe IBM’s stock is undervalued at current levels. The stock can appreciate significantly in the medium term as the company’s strategic initiatives continues to take hold and its earnings growth resume.