Left-for-Dead Gold Mining Stock is Itching to Break Out

Four years after it topped at $ 1,900 per ounce, gold has been languishing in a range closer to $ 1,200. With interest rates low and most measures registering no inflation, gold seemed to be a dead asset. Its role as a hedge was dismissed by almost everyone except for the gold sellers on TV.

Sentiment naturally turned very bearish, and that is when contrarian ears perk up.

Monday and Tuesday were unusually bullish days for the metal. However, the patterns on gold charts remain choppy-but-flat trading ranges. When viewed with a long-term eye, the trend is officially still to the downside.

That is why it seems people have gotten blindsided by recent strength in select gold mining stocks, especially since it is not sector-wide. Only the largest by market capitalization are racking up big gains, far outstripping the performance of popular gold mining indices and exchange-traded funds.

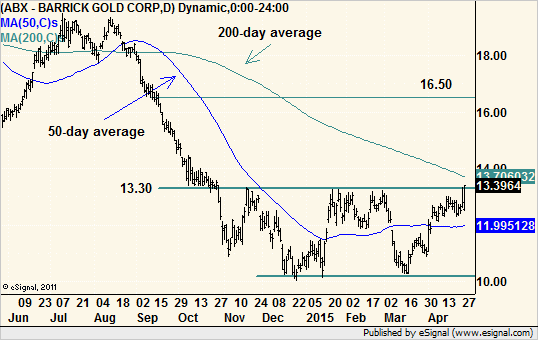

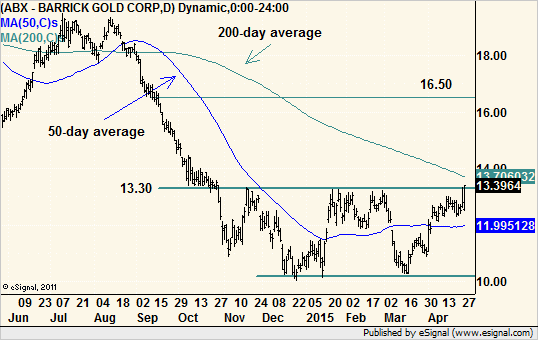

My favorite right now is Barrick Gold (NYSE: ABX). This Toronto-based, international miner looks ready to break out from a double-bottom pattern that has been in development since October.

Technical analysts always caution that trading on breakouts that have not happened yet is too risky, and I concur. But that does not mean the market is not giving us ample evidence — including the double-bottom pattern — that a breakout is indeed on its way. We don’t want to buy early, but we want to make sure we are ready if and when the breakout actually occurs.

Let’s dig in. A double-bottom pattern takes the shape of a capital letter “W” on the charts with two similar lows and a leak in between. ABX’s “W” is a bit flattened, but that does not diminish its meaning. The buy signal happens when the stock moves above resistance provided by the center peak of the pattern, which is $ 13.30 in this case.

What I like is that the stock spent several days pausing below resistance before Tuesday’s unconfirmed push through it. This is similar to a “handle” formation in a cup-and-handle pattern, and it is usually a reliable one to follow. A breakout from a pause tells us the market had a real shift from apathy to bullishness, which is better than a breakout occurring on momentum alone. The latter can often be an overshoot and a false signal.

Aside from the simple chart pattern, micro action this week also gave off a bullish vibe. On Monday, the stock rallied early despite missing its first-quarter earnings estimates. At the time, both the stock market and gold itself were rallying nicely, but by midday stocks and ABX started to sell off. Most of Barrick’s gains evaporated leaving a possible reversal bar in place.

But on Tuesday, gold kept moving higher and the stock market recovered from an early loss. Barrick responded with a sizeable gain to trade above resistance, and many large-cap mining stocks also showed big moves higher.

If ABX can sustain this breakout, or better yet move an additional 1% above it to $ 13.43, then we can go with it.

There are two caveats, the first being the proximity of the still-falling 200-day moving average. I would defer to the pattern breakout over the moving average ,although with the 200-day at $ 13.70 we would not give up much upside if we waited for that moving average to be breached.

The second is more important. The Federal Reserve will release its FOMC meeting minutes this afternoon, and while there is no reason to expect anything different that is always a possibility. Gold is in a close inverse relationship with the U.S. dollar, so if the dollar shoots higher, gold and gold stocks could see problems.

I am not going to try to outguess the hordes of Fed-watchers, so I will stick with the evidence the market has already provided on the charts. Right now, that is a fledgling breakout in a sector that is widely disliked. Anything less than a Fed shocker should allow ABX to keep its rally going with an eye on $ 16.50 as a target for a 24% return.

Recommended Trade Setup:

— Buy ABX above $ 13.30

— Set stop-loss at $ 12.50

— Set initial price target at $ 16.50 for a potential 24% gain in 12 weeks