One Man’s Plan To Secure His Daughters’ Financial Future

For novice investors it’s always the hardest part: where do you begin?

But it’s not only novice investors that have this problem. No matter where an investor falls on the learning curve, it’s tough to know what stock to buy, which strategy to pursue or which retirement account to use.

Even the basics can be overwhelming for somebody new to the market. Should you invest in a Roth IRA, Traditional IRA, Simple IRA, SEP IRA, Uni-401(k), Mutual Funds, ETFs, stocks, bonds? The list goes on… Investors are literally inundated with options. And if you go to a financial advisor, most require at least $ 50,000 and can charge outrageous fees.

Most investors start out with a few hundred bucks and stuff it in a savings account, earning next to nothing, simply because they don’t know what else to do with it.

These were the shoes Matthew Michaels, a young father who works here in the StreetAuthority office, was in when his grandparents gave his two young daughters money for Christmas last year. At first, he figured he’d use the money to buy more diapers and onesies, but after talking it over with his wife, they decided to invest it for their daughters’ futures.

So that’s exactly what they did.

But they didn’t go for the traditional savings account, CD, money market account, 529 Plan or any other traditional investment.

Instead, they opted for a unique retirement plan — one that most investors have never heard of.

It’s a retirement strategy that my colleague Amy Calistri has been developing, refining and perfecting here at StreetAuthority, for years.

It’s called the Daily Paycheck Retirement Plan.

In December 2009, she started with $ 200,000, and about five years later she’s grown the portfolio to more than $ 320,000.

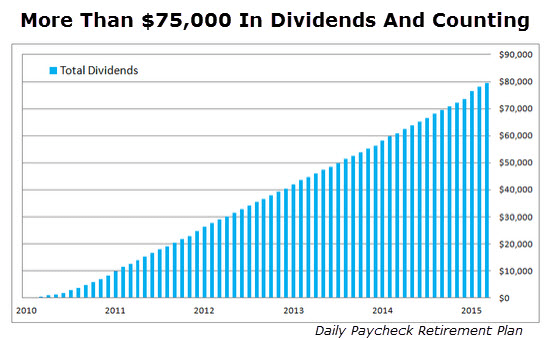

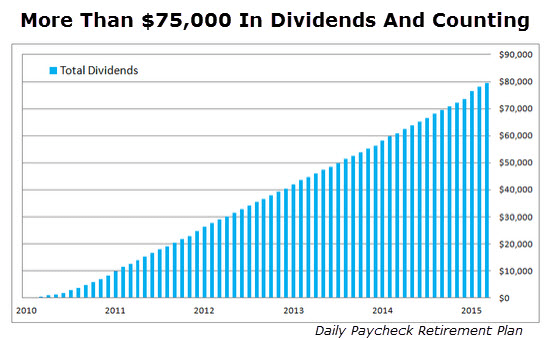

But what’s even more astonishing is that she collects a dividend paycheck, on average, every day. She’s already earned more than $ 75,000 from dividends alone.

The Daily Paycheck Retirement Plan generates more than $ 1,400 per month for Amy — more than a typical government retirement check. It offers yields as high as 15% with investments that have increased payouts for as much as 50 years in a row.

In fact, in the March issue of The Daily Paycheck, she added one of the financial industry’s leaders to her portfolio.

This firm, which is approaching its 80th anniversary, now has a stunning $ 747 billion in assets under management. Although the broader industry is growing at a single-digit pace, this company has boosted revenues at a double-digit clip for five straight years. That translates into rising market share.

These days, the firm is stepping on the gas by adding new funds, new services and moving into new international markets.

The company has some of the thickest operating profit margins in the industry — topping 45% — making it one of the most profitable companies in the S&P 500.

Amy’s decision to add this investment firm to her portfolio comes down to one simple factor: people need money for retirement. And given the troubling statistics about how prepared most people are, it’s clear they need guidance.

It’s also worth noting that the firm she picked has a dividend that keeps rising year after year (from $ 1 a share in 2009 to a recent $ 2.08). And that’s even before you factor in special one-time dividends, such as the $ 2 a share payout that the company recently doled out to investors.

Unfortunately, I can’t share the name of this firm with you today, out of fairness to her paid subscribers, but just know that — broadly speaking — you could look into any asset management and retirement firm and probably find a gem.

The bottom line is that if you’re looking for some guidance on where to safely invest your money, like Matthew is, then the Daily Paycheck Retirement Plan is a great place to look for guidance. Keep in mind that this isn’t only for those close to retirement.

Matthew is trusting his daughters’ financial future with this unique retirement plan, because there’s no minimum requirement, no outrageous fees, no early withdrawal penalties and quite frankly, it boasts one hell of a track record.

I know $ 300 is far from $ 200,000, which is what Amy started with. But as she demonstrated in a recent issue with an example portfolio, it’s possible to turn even a small amount into an income stream of thousands of dollars, provided you reinvest dividends (and if you periodically add savings to the account over time, even better).

That’s what Matthew plans to do. He will invest thousands more over the coming years, and he’ll be tracking his entire experience. In fact, he documented, on camera, his first ever high-yield trade in hopes that his experience will help other people looking for a low-risk investment plan.

You can watch Matthew take the first step toward securing his daughters’ financial futures, as well as learn more about Amy’s Daily Paycheck Retirement Strategy, by simply clicking here.