Warren Buffett’s 4 Portfolio Positions That Are On Sale

The best living investor Warren Buffett (Trades, Portfolio) had another excellent year in 2014. His company, Berkshire Hathaway (BRK.A)(BRK.B) experienced a 28% increase in book value, besting the S&P 500’s 11% gain. The outperformance takes him out of two years of returns more closely tracking the index.

Buffett gave investors some new advice to investors in his annual letter released in 2014, encouraging them to rethink volatile markets:

“If the investor, instead, fears price volatility, erroneously viewing it as a measure of risk, he may, ironically, end up doing some very risky things. Recall, if you will, the pundits who six years ago bemoaned falling stock prices and advised investing in ‘safe’ Treasury bills or bank certificates of deposit. People who heeded this sermon are now earning a pittance on sums they had previously expected would finance a pleasant retirement. (The S&P 500 was then below 700; now it is about 2,100.)”

He also said the average investor would have also done well to put money in an index fund:

“If not for their fear of meaningless price volatility, these investors could have assured themselves of a good income for life by simply buying a very low-cost index fund whose dividends would trend upward over the years and whose principal would grow as well (with many ups and downs, to be sure).”

But for those seeking to emulate Buffett’s style of buying quality businesses with strong brands, high moat, simple business models and healthy earnings growth, four stocks in his $ 109.4 billion portfolio are on sale: Wal-Mart Stores Inc. (WMT), Precision Castparts Corp (PCP), National Oilwell Varco (NOV) and Suncor Energy Inc. (SUN).

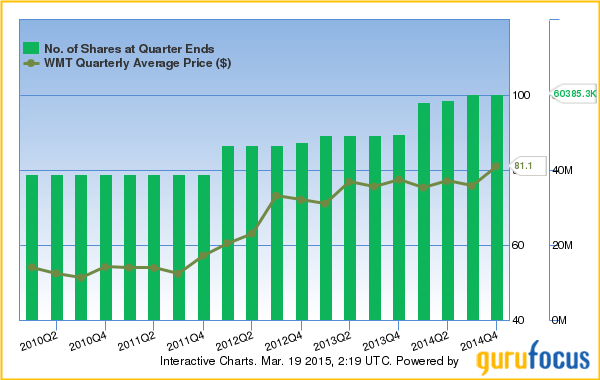

Wal-Mart Stores Inc. (WMT)

Buffett holds 60,385,293 shares of Wal-Mart Stores Inc., a major holding at 4.7% of his portfolio and the fifth largest represented. Wal-Mart’s stock price closed at $ 82.53 on Wednesday, when the GuruFocus DCF calculator assigns it a fair value of $ 153 per share, a 46% discount. So far this year, Wal-Mart shares have lost almost 4%.

The DCF calculator based the analysis on earnings per share of $ 4.99 and a 9.1% growth rate for the next 10 years, business predictability of 4.5 stars.

Wal-Mart Stores Inc., a Delaware corporation, was incorporated in October 1969. Wal-Mart Stores Inc. has a market cap of $ 266.01 billion; its shares were traded at around $ 82.53 with a P/E ratio of 17.10 and P/S ratio of 0.50. The dividend yield of Wal-Mart Stores Inc. stocks is 2.40%. Wal-Mart Stores Inc. had an annual average earnings growth of 9.70% over the past 10 years. GuruFocus rated Wal-Mart Stores Inc. the business predictability rank of 4.5-star.

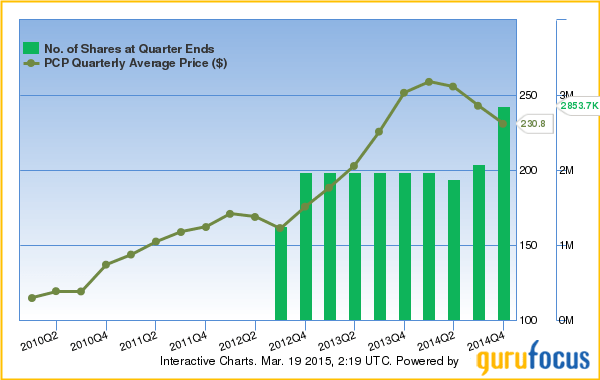

Precision Castparts Corp (PCP)

Buffett held a total of 2,853,688 shares of Precision Castparts, a 0.63% portfolio weight. The company’s stock price closed at $ 211.59 per share on Wednesday, a 43% discount to the DCF calculation of $ 268. Its stock price lost 12% year to date.

The calculation is based on earnings per share of $ 12.99, a growth rate of 20% over the next 10 years and a discount rate of 12%.

Precision Castparts Corp was incorporated in the State of Oregon. Precision Castparts Corp has a market cap of $ 30 billion; its shares were traded at around $ 211.59 with a P/E ratio of 16.10 and P/S ratio of 3.0. The dividend yield of Precision Castparts Corp stocks is 0.10%. Precision Castparts Corp had an annual average earnings growth of 19.20% over the past 10 years. GuruFocus rated Precision Castparts Corp the business predictability rank of 3-star.

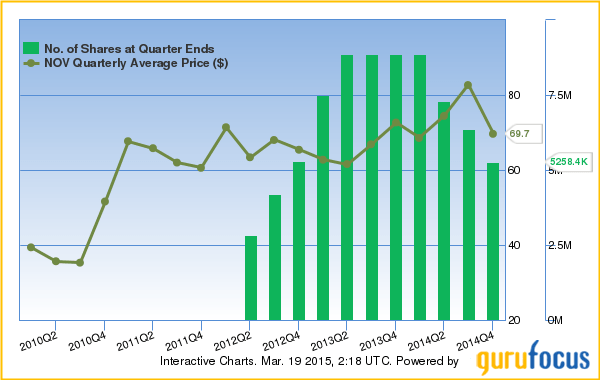

National Oilwell Varco (NOV)

Buffett’s holding of National Oilwell Varco consisted of 5,258,385 shares at fourth quarter end, worth 0.32% of the portfolio. Its share price ended Wednesday at $ 48.59, an 8% discount from the DCF calculator’s fair value of $ 53. Year to date, the stock has declined 25.9%.

The DCF calculation for National Oilwell Varco is based on earnings per share of $ 5.79, a growth rate of 20% over the next 10 years and a discount rate of 12%.

National Oilwell Varco Inc., a Delaware corporation incorporated in 1995, is a provider of equipment and components used in oil and gas drilling and production operations, oilfield services and supply chain integration services to the upstream oil and gas industry. National Oilwell Varco Inc. has a market cap of $ 19.92 billion; its shares were traded at around $ 48.59 with a P/E ratio of 8.30 and P/S ratio of 0.90. The dividend yield of National Oilwell Varco Inc. stocks is 3.80%. National Oilwell Varco Inc had an annual average earnings growth of 20.0% over the past 10 years. GuruFocus rated National Oilwell Varco Inc. the business predictability rank of 3-star.

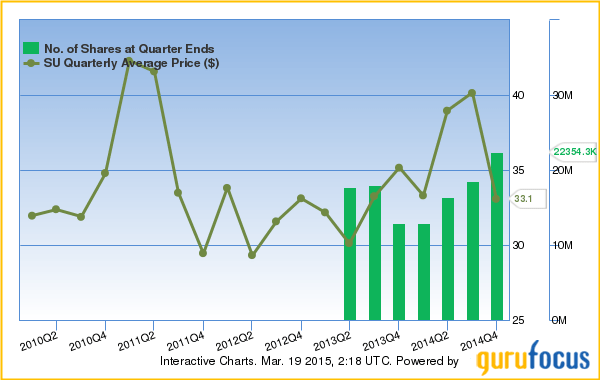

Suncor Energy Inc. (SU)

At fourth quarter end, Buffett held 22,354,294 shares of Suncor Energy, a 0.65% portfolio holding. The stock’s Wednesday closing price of $ 28.59 reflects a 1% discount to the DCF calculated share price of $ 29. The company’s stock has declined 10% this year.

GuruFocus’ DCF calculation is based on earnings per share of $ 1.66, a growth rate of 3% over the next 10 years and a discount rate of 12%.

National Oilwell Varco Inc., a Delaware corporation incorporated in 1995, is a provider of equipment and components used in oil and gas drilling and production operations, oilfield services, and supply chain integration services to the upstream oil and gas industry. National Oilwell Varco Inc. has a market cap of $ 19.92 billion; its shares were traded at around $ 48.59 with a P/E ratio of 8.30 and P/S ratio of 0.90. The dividend yield of National Oilwell Varco Inc. stocks is 3.80%. National Oilwell Varco Inc. had an annual average earnings growth of 20.0% over the past 10 years. GuruFocus rated National Oilwell Varco Inc. the business predictability rank of 3-star.