Central bankers grapple with the changing nature of competition

RECENT visitors to Jackson Hole, a resort in the Teton Mountain range in Wyoming, were denied the usual scenic views by a shroud of smoke from recent forest fires. Disappointing, no doubt, for the tourists among them—but oddly fitting for the economic panjandrums attending the Federal Reserve Bank of Kansas City’s annual symposium on August 23rd-25th. Not only are economic policymakers used to making choices in a fog of uncertainty, but this year’s theme of market structures generated its own haze. Though the nature of competition in America’s economy is changing, it is unclear how worried they should be.

Jerome Powell, the chairman of the Federal Reserve, highlighted slow wage growth in recent decades. America seems stuck in a “low-productivity mode”, he said. Others pointed to sluggish investment, despite cheap capital, and a fall in workers’ share of national income. Could these ills share some common causes, namely rising market concentration and crimped competition?

As evidence, Alan Krueger of Princeton University pointed to nominal wage growth that is 1-1.5 percentage points lower than would normally be expected with inflation and unemployment as low as they are now. He laid some blame on employers’ growing power, as no-poaching agreements and non-compete restrictions proliferate, on sickly union membership and on the falling real value of the federal minimum wage.

Antoinette Schoar of the Massachusetts Institute of Technology (MIT) remarked that a banking shakeup by fintech upstarts, long predicted, has not fully materialised. Rather than turning new firms into viable competitors, venture capital seems to have nurtured them only for incumbents to gobble them up. As markets have become more concentrated, observed John van Reenen, also of MIT, the gap in productivity between the biggest and smallest companies has widened. If something is stopping substandard firms from closing the gap, that could be sapping the economy’s dynamism.

These concerns fit into a dark story, of an economy weakened by behemoths abusing their market power. But there is a competing narrative. Consider the Jackson Hole conference itself, stuffed with star academics and policymakers. Is it an incumbent monopolist, resting on its reputation as the year’s hottest macroeconomic event? Or is it a shining example of the power of network effects, convening great minds to produce ideas jointly that surpass anything they could dream up separately?

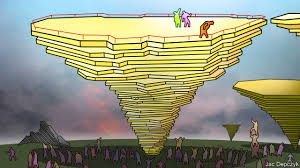

Rising market concentration, Mr van Reenen pointed out, might reflect not a decline in competition, but a change in its nature. Platforms such as Google, Uber and Airbnb match buyers and sellers, and thus make outsize gains as they grow. In such winner-takes-most competition, a slight advantage can tip the entire market in a company’s favour. Mr van Reenen finds that America’s rising economic concentration is mostly caused by big, productive companies gaining market share. Far from growing complacent and fat, they seem impressively muscular.

Other observations chimed with this narrative. Alberto Carvallo of Harvard University showed that the prices of goods sold in brick-and-mortar shops vary less by location and are updated more often if they are also sold by online rivals. Prices of shops’ products were much more likely to reflect changes in exchange rates if the same items were sold on Amazon. Such cost-sensitivity is hard to square with the idea that competition is lacking.

The differences between these rival narratives matter for economic policymakers. In one version nefarious market forces are constricting productivity, holding down investment and wages. If so, that would make the trade-off between inflation and unemployment harder to manage. In the other, restrained investment and wages are signs of structural changes that boost productive potential—in which case, there would be fewer ill-effects from running the economy hot.

Two economists, three opinions

Unsurprisingly, given the number of economists assembled, the only point of agreement was on the need for more evidence. Part of the difficulty is that the two narratives are not as distinct as they appear. As Janice Eberly and Nicolas Crouzet of Northwestern University pointed out, the same forces could be creating both competition-harming barriers to entry and rising productivity associated with economies of scale. They find a correlation between a company’s market share and its investment in patents, algorithms and other intangible capital.

Moreover, the impact on competition seems to vary by industry. In retail and manufacturing, although concentration and intangible investment have risen, the researchers’ measure of price markups has stayed low. By contrast, in the high-tech and health-care industries, they find an association between intangible investments and markups. Even as sophisticated logistical algorithms sharpen the battle between the likes of Amazon and Walmart in retailing, in other words, a proliferation of patented devices and databases full of customer insights could be enabling market leaders in pharmaceuticals and finance to shut rivals out.

Raghuram Rajan of the University of Chicago offered another reason to wait before declaring increased economic concentration either good or bad for the economy overall. Even if superstar companies are passing efficiency gains on to consumers now, they may not keep doing so indefinitely. If they continue to be boosted by the trends behind economic concentration, from stellar returns to amassing troves of customer data and the increasing sophistication of proprietary software, their pricing forbearance may not last. Once their dominance is secure, they could turn predatory, milking consumers and squeezing innovative potential from the broader business environment. The economy has changed a lot in recent years—and there is no reason why it cannot keep changing.

This article appeared in the Finance and economics section of the print edition under the headline “Made from concentrate”