Millennials: Don’t fear the market

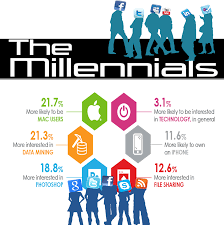

The Great Recession had quite an impact on everyone, but it seems to have made a particularly deep impression on Millennials.

A recent Bankrate survey found that only one-third of Millennials invest in the stock market through either a retirement savings account or a standard brokerage account. That’s unfortunate, because the other two-thirds are missing out on the biggest opportunity to make their money grow.

Can’t afford it

The Millennials who participated in the Bankrate survey were asked why they didn’t invest in stocks, and the most common answer they gave was that they couldn’t afford to.

In reality, you can’t afford not to save at least a little money: The sooner you start saving for retirement, the less money you’ll need to save overall in order to fund a happy retirement, because money you invest early has more time to grow.

And during the early part of your career, the stock market is the best possible place for those retirement funds. Sure, the stock market is guaranteed to take some deep dives during your lifetime, but since you don’t need to touch the money for decades, that won’t matter. As long as you don’t touch those stocks until you’re ready to retire, they’ll have plenty of time to recover their value and then some.

Even if you’re only saving 2% of your salary in the company 401(k), or $ 50 a month in an IRA, you’re doing something to protect your future.

Don’t know how

The second-most commonly cited reason for not investing in stocks is that Millennials apparently know little or nothing about them.

Fortunately, you don’t have to be Warren Buffett to pick the right stocks to invest in. In fact, Buffett himself has said repeatedly that the best move for a new investor would be to simply buy shares of the Vanguard S&P 500 ETF (VOO). With such an index fund, you’re buying a tiny percentage of hundreds of companies, meaning your risk is spread out over many different types of stocks.

And an index fund makes it easy to “set and forget” your retirement investments; all you need to do is check in once per year to make sure the balance between your stocks and bonds is appropriate for your age. A good guideline for that is to subtract your age from 110 and put that percentage of your money into stocks, with the rest in bonds. For example, if you’re 30, you’d have 80% in stocks and 20% in bonds.

An even simpler investing strategy, and one that’s available in nearly every 401(k) plan these days, is a target date fund. These funds take care of allocating your money between stocks and bonds for you, and they adjust your allocation as you draw closer to your chosen retirement date.

Looking past the 401(k)

If your company doesn’t offer a 401(k) option, then setting up an IRA is your best course of action. An IRA has one major advantage over a 401(k): It gives you access to way more investment options.

Of course, if you’re trying to keep things simple, by all means stick with a target date fund or a combination of an S&P 500 index ETF and a good bond ETF. Just about every bank and brokerage on the planet now offers IRAs, so finding a good one won’t be difficult.

Related links:

• Motley Fool Issues Rare Triple-Buy Alert

• This Stock Could Be Like Buying Amazon in 1997

• 7 of 8 People Are Clueless About This Trillion-Dollar Market

Retirement might seem like it’s a long way away, but today is the best time to start preparing for it — and stocks are the best way to do so.