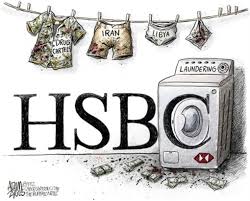

An HSBC Money Laundering Report Can Stay Confidential—For Now

A U.S. appeals court on Wednesday blocked the release of a report discussing HSBC Holdings Plc’s progress in improving its controls against money laundering, reversing a judge’s order that the report be made public.

The 2nd U.S. Circuit Court of Appeals in Manhattan said U.S. District Judge John Gleeson abused his discretion in his January 2016 ruling that the public had a constitutional right of access to the report under the First Amendment.

HSBC had agreed to a monitor in December 2012, when it accepted a $ 1.92 billion fine and five-year deferred prosecution agreement to resolve a U.S. Department of Justice criminal probe.

The department said HSBC had become a preferred bank for Mexican drug cartels and other money launderers, and conducted transactions for customers in several countries barred by U.S. sanctions.

Wednesday’s decision was a victory for HSBC and the Justice Department, which have said releasing the report could compromise efforts to fight money laundering, including for terrorism, and discourage cooperation with law enforcement.

It was a defeat for Hubert Dean Moore, a Pennsylvania man who was an HSBC mortgage customer before filing for bankruptcy, and sought the report’s release to identify whether problems persisted in HSBC’s business practices.

The report was kept under seal during the appeal.

“We are pleased with the outcome,” HSBC chief legal officer Stuart Levey said in a statement. “This decision allows HSBC’s agreement with the Justice Department to operate as intended.”

HSBC admitted to violations in accepting the agreement, but could see the criminal case dropped by complying with its terms.

Moore and his lawyer did not immediately respond to requests for comment. A spokesman for the Justice Department declined to comment.

Public Trust

Twenty-five media outlets including Dow Jones, Gannett, National Public Radio and the New York Times had also sought the report’s release.

They said such documents, especially if fraud or executive branch conduct were at issue, help the public hold the government accountable and understand how courts work.

“Public trust and confidence in the rule of law and the judicial system was at stake,” Dennis Kelleher, CEO of nonprofit Better Markets, said in a statement. “Unfortunately, the court has put private interests above the public interest.”

In his ruling, Gleeson had said the report by the monitor Michael Cherkasky, a former New York prosecutor and now executive chairman of compliance company Exiger, implicated “matters of great public concern.”

But the appeals court said the Justice Department oversees implementation of deferred prosecution agreements, which judges lack “freestanding supervisory power” to do even if they suspect problems.

“In resting its exercise of supervisory authority on hypothesized scenarios of egregious misconduct, the district court turned this presumption on its head,” Chief Judge Robert Katzmann wrote.

The appeals court concluded that Cherkasky’s report was not a “judicial document” deserving of public access.

Gleeson, who sat in Brooklyn and is now a partner at the law firm Debevoise & Plimpton, declined to comment.

In a concurrence, Circuit Judge Rosemary Pooler called on Congress to give courts “meaningful oversight” of companies’ compliance with deferred prosecution agreements, rather than letting prosecutors “act as prosecutor, jury, and judge.”

The case is U.S. et al v. Moore, 2nd U.S. Circuit Court of Appeals, No. 16-308.