The $25,000 Bet That Moved Trillions of Dollars…

Moments ago, our friend Ben Hunt of Epsilon Theory noted something which we first touched upon over the weekend, when we hinted (and many promptly took as another case of “tinoil hat” speak) that it is very easy to manipulate (especially for those in the financial industry who handle and trade massive sums of money) London bookie odds in order to influence if not the outright public Brexit polls – although one can certainly make the case for reflexivity here as well- then certainly the market. After all the one thing that unleashed the wave of early buying in the global markets today was not new polls, but the odds for “Leave” at both Ladbrokes and William Hill tumbling, and hitting as low as 25% after surging to record highs of over 40% last week.

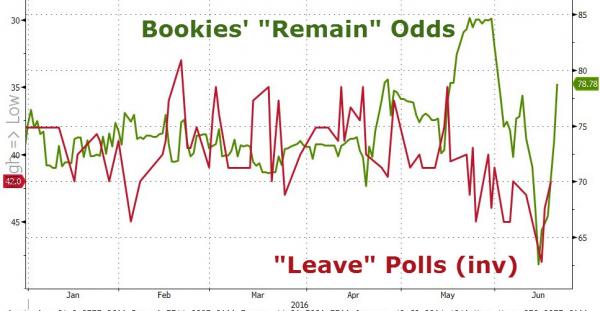

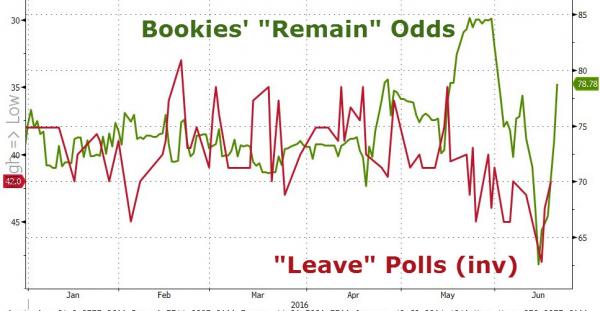

In this context, earlier we showed todays’s dramatic discrepancy between “Leave” polls (inverted) and Bookie Remain odds, demonstrating how far ahead of actual polls some aggressive bettors had taken the Bookie line.

To this, Hunt commented that the market swinging on nothing but UK betting lines equates to “high risk of mkt manipulation” adding that one could move $ 10 trillion in global risk assets with £1 million bet.

As Matthew Shaddick, head of politics at Ladbrokes explains in the following BBG TV interview, the biggest bet today moving the odds was a meager £25,000!

Which direction? The one which sent stocks soaring, of course.

The trade here is simple: buy millions worth of ES calls while go long the GBPUSD, then buy a few thousand worth of “Remain” bets, move the betting market, and send both the transfied S&P500 and cable sky high.

Outcome: small bet, huge profits.

(Incidentally, Shaddick revealed that Ladbrokes’ betting book would make money if Brexit – where it has a positive position – won, adding that “we’d lose a little if it was Remain but not too much.”)