Citi Is Confused Why People Read “Bearish Stories”

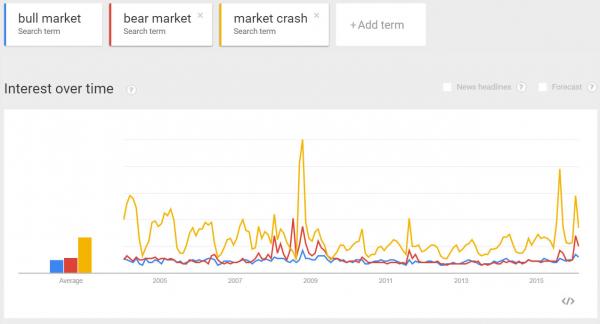

n his daily note to clients, Citi’s Brent Donnelly is confused: he asks why do people focus on “bearish news” and shows a Google trends chart to support his theory. This is what he said:

In an email I sent Monday, I was critical of the financial media for highlighting bearish stories but ignoring bullish ones. I was thinking about this and realized that maybe you can’t blame the commentators… People just gravitate towards bad news—humans are much more interested in watching a car crash or shooting on TV than a feel-good story.

I looked at Google searches related to the stock market. The results (Chart1) speak for themselves. My conclusion is that it’s not fair to blame Zerohedge and friends for the permabear newsflow… They’re just giving the people what they want!

Since this is a topic we have covered extensively over the years, we won’t waste much time responding to Mr. Donnelly and instead reply in pithy kind:

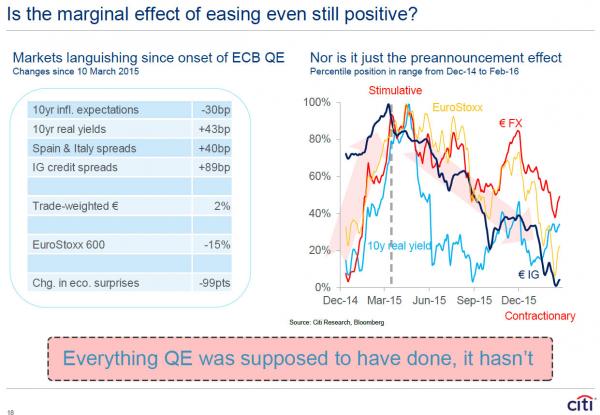

What people want is not bearish news, what they want is the truth, something they, for whatever reason, feel they can’t get from the mainstream media, which in turn has opened up opportunities to alternative media outlets such as “Zerohedge and friends.” Incidentally, these outlets are not only not permabears – we remind Mr. Donnelly that our “trade of the year” which we presented on February 12, and which returned 30% in just two days was to go long Chesapeake bonds – but are observations always backed by facts, virtually all of which have to do with documenting and narrating the plight of an overhyped recovery which never took place (something which incidentally the following slide from, uh… Citi, shows)

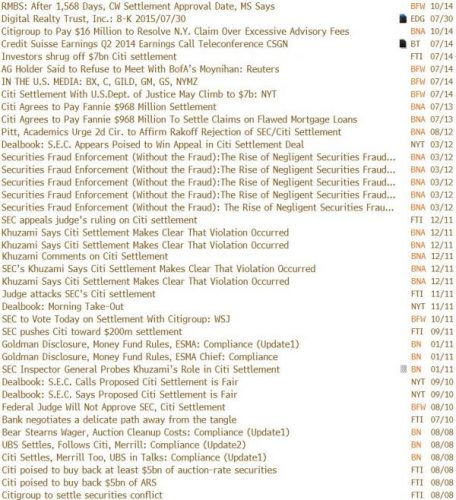

… and detailing the broken and rigged market, as the following simple news query shows:

As for whether Mr. Donnelly has a problem with “Zerohedge and friends” laying out those things which he prefers not to discuss, we would recommend he stay away from the most recent report written by his Citi co-worker, Matt King, titled permabearishly enough “Don’t look down – You might find too many negatives” and which we summarized in the following post: “Citi: we have a problem.”

If Mr. Donnelly is still confused by the difference between truth and “bearish news”, we are happy to explain it further. That, or maybe he should just read the following story just released by our “permabearish friends” at Bloomberg… who simply want to give people what they want: