As Bank of Japan switches gears, roaring dollar hits the skids

The dollar’s biggest bull run in 40 years may have finally come to a screeching halt, now that the world’s last dovish central bank – the Bank of Japan – has finally relaxed its iron grip on long-term interest rates. The BOJ shocked markets on Tuesday with a surprise tweak to bond yield control, allowing long-term interest rates to rise more in a move aimed at easing some of the costs of prolonged monetary stimulus. BOJ Governor Haruhiko Kuroda, who steps down in April, said this was a technical measure aimed at improving the way the bond market works and in no way was a form of monetary tightening.

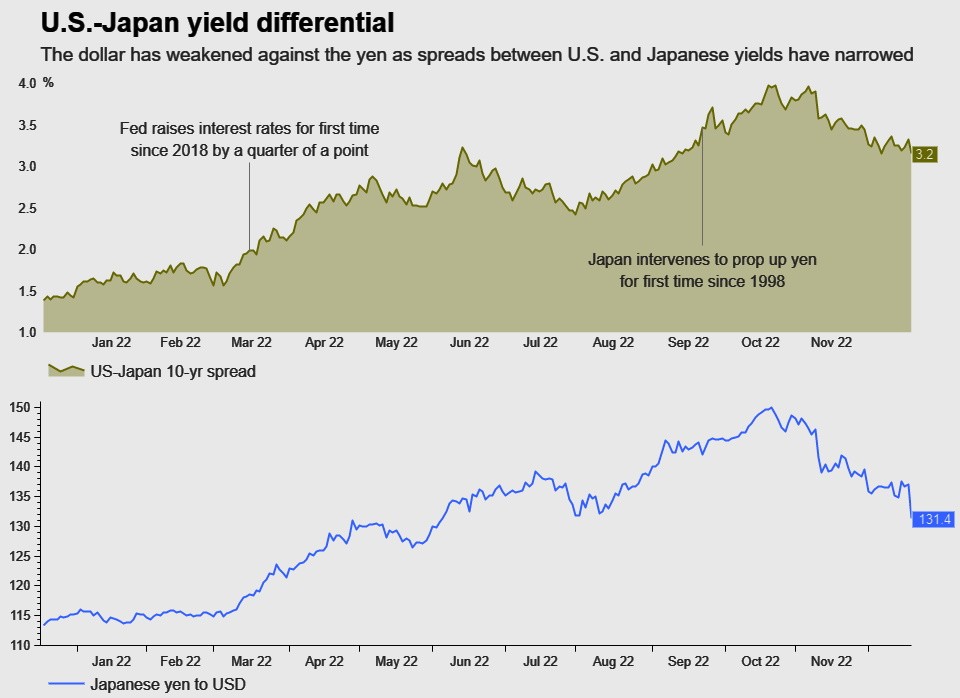

The timing caught investors off guard, pushing the yen up roughly 4% against the dollar, its largest one-day gain in 34 years . The dollar was last down 3.9% at 131.60 yen. Benchmark Japanese 10-year yields to their highest in seven years – effectively doubling long-term borrowing costs. The BOJ’s move will likely reduce demand for U.S. Treasuries, analysts said. Japan, the world’s largest non-U.S. holder of U.S. government debt, has reduced its load of Treasuries for the last several months, selling them to defend the yen that at one point lost about 25% of its value against the dollar and as hedging costs have skyrocketed.

The dollar has risen 9% this year, as the Federal Reserve has jacked up interest rates to combat inflation at 40-year highs. It has clocked the most gains against the yen, which has been weighed down by the BOJ’s policy of controlling longer-term yields. As other central banks, from the Bank of England, to the European Central Bank, and the Reserve Bank of Australia, have raised their own rates, dollar bulls have run out of puff. Against a basket of major currencies , the U.S. currency is heading for its biggest quarterly loss since late 2010. But the dollar could, until now, count on its edge against the yen, to prolong its bull run.

Societe Generale’s head of FX strategy Kit Juckes said the dollar’s second-biggest run-up since February 1985 was effectively over. “However we dress up the world, the Fed is crawling towards the end of its rate-hiking cycle,” he said. “The rate hikes are going to get smaller and smaller and eventually, there will be nothing and that will be the end of that story.” The close relationship between Japanese monetary policy and U.S. Treasuries adds another twist to the story.

After the BOJ’s decision, U.S. 10-year Treasuries sold off, pushing yields higher by as much as 13 basis points to 3.71%. They were last up 10 bps on the day at 3.691%. “A further reduction in demand from the world’s largest holder of Treasuries should add to volatility and exacerbate any potential duration sell-off in 2023,” Erik Nelson, macro strategist, at Wells Fargo Securities, said in a research note.

HEDGING BETS

The surge in front-end rates as well as the dollar’s overall appreciation have pushed hedging costs of holding U.S. fixed-income assets for Japanese investors. Hedged 10-year Treasuries are now yielding less than -1%, according to data from Adam Cole, currency strategist, RBC Capital Markets, having fallen below the yield of a 10-year JGB earlier this year. That hasn’t changed with Tuesday’s BOJ move.

“Since Japan is not changing the policy rate, you would still have high hedging costs for Japanese investors buying U.S. dollar fixed-income assets and hedging their currency risk, while … yields on JGBs (Japanese government bonds) and investment grade credit are rising,” said Zachary Griffiths, senior investment grade strategist at CreditSights in Charlotte, North Carolina. As shorter-dated U.S. Treasury yields have risen – reflecting the belief among investors that the Fed will keep raising rates for the coming months – they have shot above longer-dated ones, which makes it far more expensive to hedge.

This pushes forward currency rates below current, or spot rates, meaning investors that have locked in their dollar exposure – which they need to buy Treasuries – are faced with the prospect of losing out when they eventually swapped those dollars back into yen. That said, some analysts believe the stress of owning Treasuries is likely “at the margin”, not least because of the sheer size of Japanese investors’ holdings of U.S. debt, analysts said.

“In terms of Japanese investors bringing money home – even if you look on a dollar/yen basis for example, you still get an enormous pickup in U.S. Treasuries if you’re a Japanese investor, before switching back into yen,” Rabobank senior rates strategist Richard Maguire said. “So I don’t think the maths stack up. I don’t think this sees a wholesale repatriation of Japanese investment back into JGBs, which would be negative for (German) Bunds, (Italian) BTPs and U.S. Treasuries.”

JPMorgan strategists say high-grade corporate bonds will also feel the pinch, as it fuels global volatility, but there is a silver lining. “The question will now center on whether the market believes the BoJ that this is simply a technical adjustment or the beginning of a more profound hawkish pivot,” JPMorgan credit strategists Eric Beinstein and Nathaniel Rosenbaum said. “The latter would imply more rate volatility but also a path to eventual lower hedging costs.”