China Crashes Most Since 2007 Amid “Panic Sentiment”

Some context…

For a record 12th day in a row, Chinese margin debt balances have dropped with today’s 8.5% collapse the largest in history. As of last night, there were around 570/1694 Shenzhen stocks halted/suspended and hundreds more on the Shanghai bourse leaving more than 54% of all Chinese stocks frozen ($ 2.6 trillion or 40% of value). China continues to try to manage leverage down (raising margin requirements on stock futures) while encouraging speculation (easing rules for insurers to buy blue chips and financing the purchase of smaller company shares directly) and CYNK’ing the entire market – if it’s not open, you can’t sell it and the price cannot fall! It’s not working as CSI-300 futures are now down 7.9% in the preopen.

- *CHINA TRADING HALTS FREEZE $ 2.6 TRILLION, 40% OF TOTAL VALUE

China appears to be trying to manage leverage…

- *CHINA RAISES MARGIN REQUIREMENT FOR CSI 500 INDEX FUTURES

- *SHANGHAI MARGIN DEBT FALLS 8.5%, BIGGEST ONE-DAY DROP ON RECORD

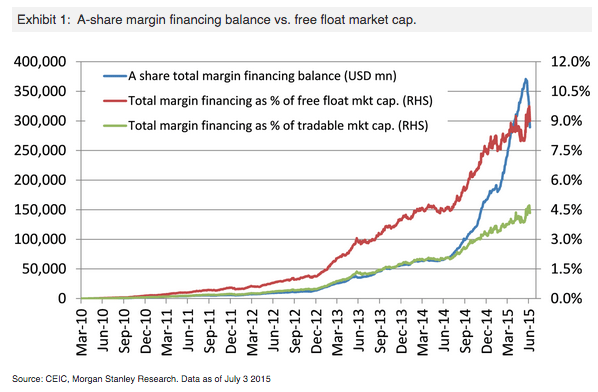

The problem is the collateral value is falling faster than the margin debt leaving “leverage” still at record highs…

While encouraging speculation…

- *CHINA EASES RULES FOR INSURERS TO INVEST IN BLUE CHIPS: XINHUA

- *CHINA SECURITIES FINANCE TO BUY MORE SMALLER COS. SHRS: CSRC

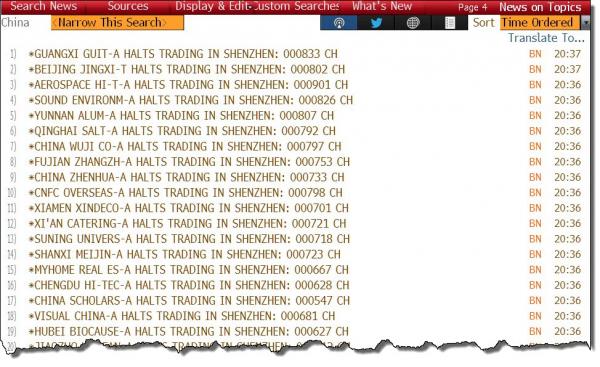

China news is domninated by dozens of pages of this…

- *CHINA TRADING HALTS LEAVE 43% OF ENTIRE STOCK MARKET FROZEN

- *1,249 CHINESE COMPANIES HAVE HALTED TRADING IN SHARES

- UPDATE: Trading halts have left 1544 companies, equivalent of 54.7% of the Shanghai Composite and Shenzhen Composite, suspended today. (@GregorHunter)

With what we estimate is around 850-900 Shenzhen Composite stocks suspended (over half of the 1694 stocks in the index) and almost 25% of Shanghai Composite stocks, it appears China has resorted to the endgame in managing a collapse…

if it’s not open, you can’t sell it and the price cannot fall!

In other words – the whole Chinese market just got CYNK’d

* * *

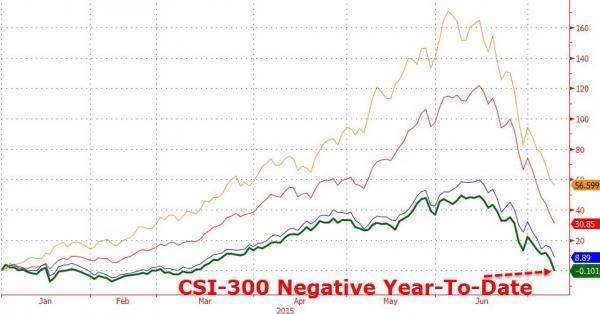

It’s not working…

- *CSI 300 JULY FUTURES PLUNGE 7.9% IN SHANGHAI

- *CHINA’S SHANGHAI COMPOSITE INDEX SET TO OPEN 7% LOWER

It looks like today could see China go red for the year…

* * *

China weakness and European rhetoric wearing S&P futures lower (down 11 points from cash close)…

* * *

Another day another attemnpt to stabilize…

Just add this to the list of interventions…

Perhaps if you just stare at it long enough, it will rise…

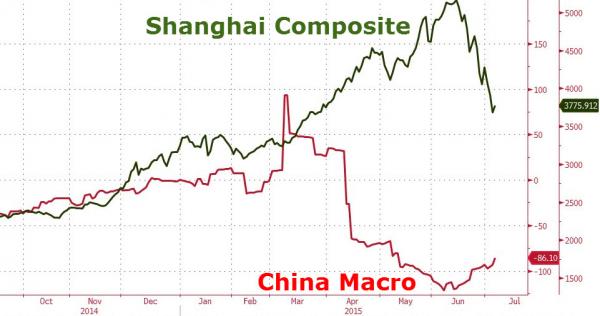

Just remember this crash is telling us somethinmg about China…

The stock market knows more than any individual investor, and China’s is no exception.

As NYU Professors Jennfier Carpenter and Robert Whitelaw told CNBC in January…

This optimism should be taken seriously. This run-up is not a bubble, and so investors should not fear another crash.

Our research shows that after a rocky first decade, which earned China’s stock market a reputation as a casino, stock prices in China predict future profits as well as they do in the U.S. Moreover, this predictive power is highly correlated with China’s corporate investment efficiency, suggesting that stock prices are teaching corporate managers important lessons as well. However, capital in China is still allocated almost entirely by its massive banking sector. It is time to untie the hand of the stock market, reform listing standards, streamline the IPO approval process now holding up over 600 firms seeking equity capital, and let the stock market allocate capital, too.

Shut Up!!!

As we detailed earlier – none of this was real or indicative of any real economic growth – it was all speculative ponzi and will not end well…

Exhibit 1 – Based on ‘fundamentals’, The Shanghai Composite has a long way to go…

Exhibit 2 – If Dr. Copper is right about the state of the world, The Shanghai Composite won’t find support until it has fallen another 60%…

Exhibit 3 – Judging by historical analogs, The Shanghai Composite will need to destroy all gains in the last 2 years before ‘value’ is once again seen…

Chinese investor psychology has shifted. Period. The more the government intervenes to lift stock prices explicitly, the more local and professsional leveraged investors will use any strength to unwind their positions (profitably or unprofitably).